This past January, another bipartisan collaboration — between Alicia Munnell, who was an economist in the Clinton administration and who now serves as the director of Boston College’s Center for Retirement Research, and Andrew Biggs, a senior fellow at the American Enterprise Institute, a conservative think tank — published a paper calling for a reduction or an end to the 401(k) tax benefit.

Their research showed that it had not led to more participation in the program nor had it significantly increased the amount that Americans in the aggregate were saving for retirement. It was mostly just a giveaway to upper-income investors and a costly one at that. They estimated that it deprived the Treasury of almost $200 billion in revenue annually. They proposed reducing or even ending the tax-deferred status of 401(k)s and using the added revenue to shore up Social Security.

When I spoke to Biggs, he emphasized that he was not against 401(k)s. On balance, he thinks that they have worked well, and he also says that some of the criticism aimed at them is no longer valid. For instance, the do-it-yourself aspect is overstated: Most plans, for instance, now offer target-date funds, which automatically adjust your asset allocation depending on your age and goals, freeing you from having to continuously readjust your portfolio yourself. He acknowledges that rescinding the tax preferences could be tricky politically: The people who have chiefly benefited from them are also the people who write checks to campaigns. But he is confident that Americans can ultimately be persuaded to give up the tax advantages. “If we say to people, ‘Look, we can slash your Social Security benefits or increase your Social Security taxes, or we can reduce this useless subsidy that goes to rich people who don’t need the money’ — well, that’s a little more compelling.”

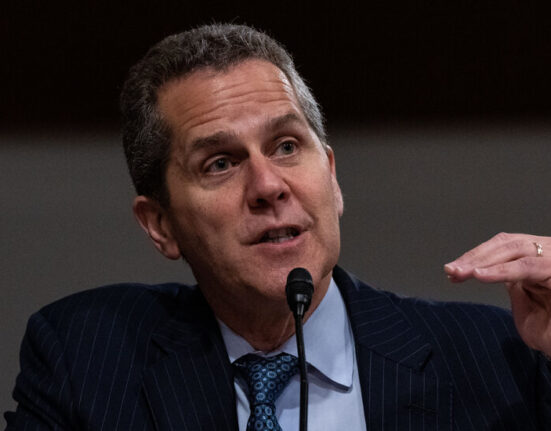

Hassett told me that his work with Ghilarducci does not represent any softening of his faith in the free market. Quite the opposite: He sees government intervention to boost retirement savings as a necessary step to preserving American capitalism. Hassett has been concerned for some time that the country is drifting toward socialism — the subject of his most recent book — and part of the reason is that too many Americans are economically marginalized and have come to feel that the system doesn’t work to their benefit.

“They feel disconnected, and they are disconnected,” Hassett says. Having the government help them save for retirement would be prudent. “It would give them more of a stake in the success of the free-enterprise system,” he says. “I think it’s important for long-run political stability that everybody gets a stake.”

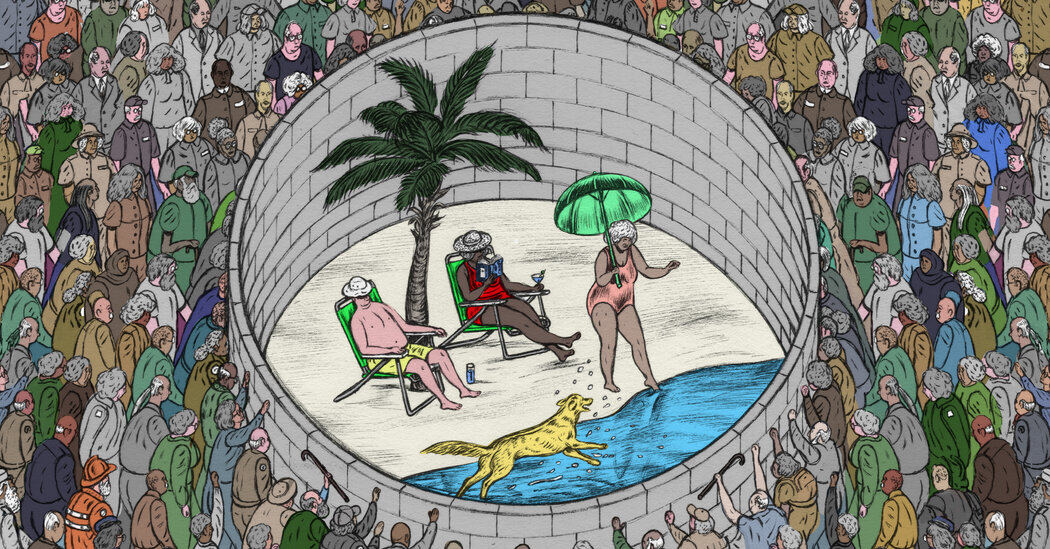

Jen Forbus is not economically marginalized, but many in her community struggle. Lorain, a city of about 65,000 on the shore of Lake Erie, has never recovered from the loss of a Ford assembly plant and two steel plants. Around 28 percent of Lorain’s residents now live in poverty. By the grim standards of her area, Forbus is doing well. “I’m definitely privileged,” she says. Even so, she knows that despite her diligent saving and careful budgeting, there is a good chance that she will not be able to retire at 65. She dreads the prospect of having to remain in the labor market as an elderly person. “Something like waitressing — past a certain age, that’s really difficult,” she says. And she admits that she finds it jarring that even for someone like her, retirement may be an unachievable objective. “I do feel our system fails too many people,” she says.